CCL Rates Announced for 2020/2021/2022

The Finance Bill 2019/2020 will continue to re-balance the electricity and gas main rates of CCL to incentivise more efficient energy and carbon savings.

The electricity rate will be lowered in 2020/2021 and 2021/2022 and the gas rate will increase in these years so that it reaches 60% of the electricity rate by 2021/2022.

The reduced rates for sectors with Climate Change Agreements will change so that businesses in the scheme will only be subject to an increase to their CCL liability in line with the Retail Price Index.

Climate Change Levy Main Rates

| Taxable Commodity | Rate from 01/04/2019 | Rate from 01/04/2020 | Rate from 01/04/2021 |

|---|---|---|---|

| Electricity (£ per kWh) | 0.00847 | 0.00811 | 0.00775 |

| Natural gas (£ per KWh) | 0.00339 | 0.00406 | 0.00465 |

| LPG (£ per kg) | 0.02175 | 0.02175 | 0.02175 |

| Other taxable commodity (£ per kg) | 0.02653 | 0.03174 | 0.03640 |

Climate Change Levy Reduced Rates

| Taxable Commodity | Rate from 01/04/2019 | Rate from 01/04/2020 | Rate from 01/04/2021 |

| Electricity | 7% | 8% | 8% |

| Natural gas | 22% | 19% | 17% |

| LPG | 22% | 23% | 23% |

| Other taxable commodity | 22% | 19% | 17% |

Carbon price support (CPS) Rates

The CPS rate per tonne of carbon dioxide (tCO2) will be frozen at £18.00 for 2020/2021 to provide stability for the electricity market.

| Carbon Price Support | Rate from the 01/04/2016 to 31/03/2021 |

|---|---|

| Carbon Price Equivalent (tCO2) | £18.00 |

| Supplies of Commodity used in Electricity Generation | |

| Natural Gas (kWh) | £0.00331 |

| Liquefied Petroleum Gas (kg) | £0.05280 |

| Coal/Solid Fossil Fuels (GJ) | £1.54790 |

| Gas Oil/Bio-blend/Kerosene (litre) | £0.04916 |

| Fuel Oil/Heavy Oil/Light Oil (litre) | £0.05711 |

The Effects of CCL Rate Changes 2021/2022

2EA Consulting Limited recently published a paper on the effects that Climate Change Levy (CCL) rate changes would have on businesses in the UK. With the publication of the CCL rates for 2020/2021 and 2021/2022 by the government in the Finance Bill 2019/2020, we have updated our analysis to reflect the changes in the CCL rates now published.

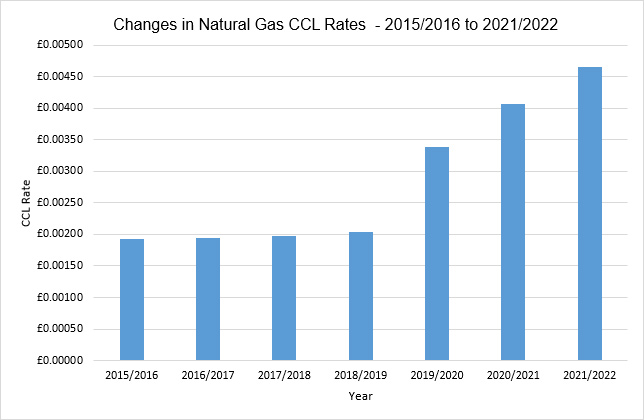

Natural Gas

CCL rates for natural gas have increased by the Retail Price Index (RPI) since 2015/2016, with a significant increase from 2019/2020; this is set to continue in both 2020/2021 and 2021/2022 until it reaches 60% of the electricity rate:

The increases in the CCL rates for Natural Gas will see further year-on-year increases in the CCL payable to the government:

| Sector | Consumption (kWh) | CCL Rate (2020/2021) | CCL Payable (2020/2021) | CCL Rate (2021/2022) | CCL Payable (2021/2022) |

|---|---|---|---|---|---|

| Hotels | 8,662,142 | £0.00406 | £35,168.30 | £0.00465 | £40,278.96 |

| Retail/Supermarkets | 947,795 | £0.00406 | £3,848.05 | £0.00465 | £4,407.25 |

| Leisure Centres | 1,683,655 | £0.00406 | £6,835.64 | £0.00465 | £7,829.00 |

| Hospitals | 7,020,269 | £0.00406 | £28,502.29 | £0.00465 | £32,644.25 |

| Office Blocks | 476,537 | £0.00406 | £1,934.74 | £0.00465 | £2,215.90 |

| Schools | 542,604 | £0.00406 | £2,202.97 | £0.00465 | £2,523.11 |

| GP Practices | 53,751 | £0.00406 | £218.23 | £0.00465 | £249.94 |

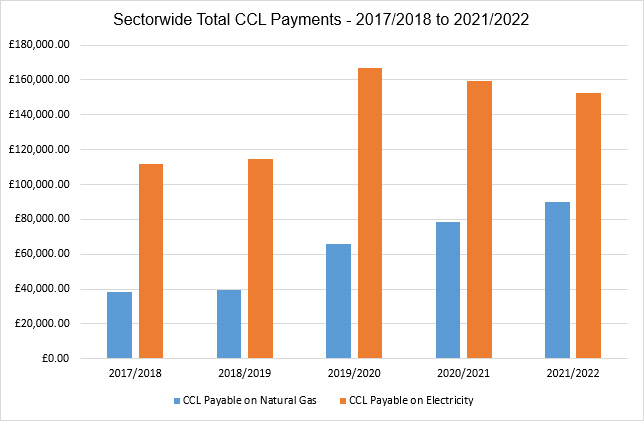

If we compare these changes in cost from the year 2017/2018 to those predicted for 2021/2022, then effectively the CCL payable on Natural Gas will have doubled in this period:

| Sector | 2017/2018 | 2018/2019 | 2019/2020 | 2020/2021 | 2021/2022 |

|---|---|---|---|---|---|

| Hotels | £17,151.04 | £17,584.15 | £29,364.66 | £35,168.30 | £40,278.96 |

| Retail/Supermarkets | £1,876.63 | £1,924.02 | £3,213.03 | £3,848.05 | £4,407.25 |

| Leisure Centres | £3,333.64 | £3,417.82 | £5,707.59 | £6,835.64 | £7,829.00 |

| Hospitals | £13,900.13 | £14,251.15 | £23,798.71 | £28,502.29 | £32,644.25 |

| Office Blocks | £943.54 | £967.37 | £1,615.46 | £1,934.74 | £2,215.90 |

| Schools | £1,074.36 | £1,101.49 | £1,839.43 | £2,202.97 | £2,523.11 |

| GP Practices | £106.43 | £109.11 | £182.22 | £218.23 | £249.94 |

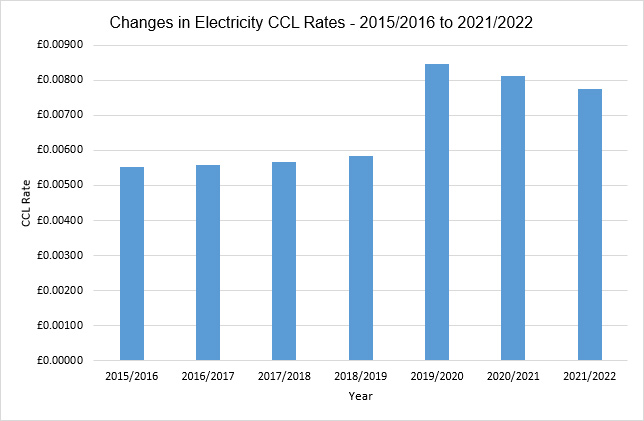

Electricity

CCL rates for electricity have also increased by RPI since 2015/2016, again with a significant increase from 2019/2020; however, the CCL rate for electricity is set to decrease in 2020/2021 and 2021/2022:

These changes are reflected in the reduction in CCL payable to the government for the periods shown below:

| Sector | Consumption (kWh) | CCL Rate (2020/2021) | CCL Payable (2020/2021) | CCL Rate (2021/2022) | CCL Payable (2021/2022) |

|---|---|---|---|---|---|

| Hotels | 2,704,105 | £0.00811 | £21,930.29 | £0.00775 | £20,956.81 |

| Retail/Supermarkets | 3,791,180 | £0.00811 | £30,746.47 | £0.00775 | £29,381.65 |

| Leisure Centres | 919,970 | £0.00811 | £7,460.96 | £0.00775 | £7,129.77 |

| Hospitals | 11,595,555 | £0.00811 | £94,039.95 | £0.00775 | £89,865.55 |

| Office Blocks | 396,715 | £0.00811 | £3,217.36 | £0.00775 | £3,074.54 |

| Schools | 222,129 | £0.00811 | £1,801.47 | £0.00775 | £1,721.50 |

| GP Practices | 55,969 | £0.00811 | £453.91 | £0.00775 | £433.76 |

If we compare these changes in cost from the year 2017/2018 to those predicted for 2021/2022, then the CCL payable on Electricity is still significantly higher, an average increase of approximately 36% from the costs of 2017/2018:

| Sector | 2017/2018 | 2018/2019 | 2019/2020 | 2020/2021 | 2021/2022 |

|---|---|---|---|---|---|

| Hotels | £15,359.32 | £15,764.93 | £22,903.77 | £21,930.29 | £20,956.81 |

| Retail/Supermarkets | £21,533.90 | £22,102.58 | £32,111.29 | £30,746.47 | £29,381.65 |

| Leisure Centres | £5,225.43 | £5,363.43 | £7,792.15 | £7,460.96 | £7,129.77 |

| Hospitals | £65,862.75 | £67,602.09 | £98,214.35 | £94,039.95 | £89,865.55 |

| Office Blocks | £2,253.34 | £2,312.85 | £3,360.18 | £3,217.36 | £3,074.54 |

| Schools | £1,261.69 | £1,295.01 | £1,881.43 | £1,801.47 | £1,721.50 |

| GP Practices | £317.90 | £326.30 | £474.06 | £453.91 | £433.76 |

Looking at the total CCL payments across the sectors, we can see that climate change levy will still be a significant burden upon business in the years to come.

View Our Climate Change Levy (CCL) Multi-Sector Analysis White Paper here

Note: The CCL payments shown assume no change in energy consumption for the years shown.