Understanding Climate Change Levy and the role CHPs in Leisure Centres

Climate Change Levy (CCL) was introduced in 2001 under the Finance Act 2000 for non-domestic organisations. It was initially offset by a reduction in National Insurance contributions for businesses and was launched to encourage them to operate in a more environmentally friendly way.

CCL is applied to electricity, gas, liquid petroleum gas (LPG) and solid fuels. It appears on non-domestic electricity and gas bills as CCL. It is applied at the time of supply and is charged on the energy used. However, exemptions for supplies from certain renewable sources and Combined Heat and Power (CHP) may be applicable.

By installing and operating a CHP unit, a business can apply for CCL relief on the gas used by the CHP unit by being registered with the Department of Business, Energy & Industrial Strategy (BEIS) CHP Quality Assurance (CHPQA) Programme.

CCL is calculated based on the amount of energy being supplied and is charged by the supplier of the taxable commodity. Suppliers then pay the collected tax to HM Revenue and Customs. CCL is often shown as a separate line item on energy bills (usually above the VAT line) and is also VAT chargeable. It is charged at a flat rate on every kilowatt-hour (kWh) of energy used.

The rates for CCL change every year. These changes are normally announced during the Chancellor’s budget(s). At present, the rates only go up to 2023/2024.

| Commodity | 2019/2020 | 2020/2021 | 2021/2022 | 2022/2023 | 2023/2024 |

|---|---|---|---|---|---|

| Electricity | £0.00847 | £0.00811 | £0.00775 | £0.00775 | £0.00775 |

| Gas | £0.00339 | £0.00406 | £0.00465 | £0.00568 | £0.00672 |

| LPG | £0.02175 | £0.02175 | £0.02175 | £0.02175 | £0.02175 |

Based on average energy consumption, a leisure centre operating in the UK applying the 2021/2022, 2022/2023, 2023/2024 rates for CCL; will see a year-on-year increase in their CCL costs:

| Average Annual Consumption (kWh) | CCL Payable – 2021/2022 | CCL Payable – 2022/2023 | CCL Payable – 2023/2024 | ||||

| Electricity | Natural Gas | Electricity | Natural Gas | Electricity | Natural Gas | Electricity | Natural Gas |

|---|---|---|---|---|---|---|---|

| 919,970 | 1,683,655 | £7,129.77 | £7,829.00 | £7,129.77 | £9,563.16 | £7,129.77 | £11,314.16 |

| Total CCL Costs | £14,958.77 | £16,692.93 | £18,443.93 | ||||

To work out your leisure centres’ CCL costs and compare them to previous years. You can use our CCL calculator tool.

By operating a CHP scheme, a leisure centre can reduce the amount of electricity imported from the grid and the amount of gas used in the site boilers to generate heat.

A 160 kWe CHP unit operating 17 hours/day would expect to generate annual savings of approximately £69,000 based average grid prices for gas and electricity.

CHPs and the CHPQA Programme

By installing and operating a CHP unit, a business can apply for CCL relief on the gas used by the CHP unit by being registered with the Department of Business, Energy & Industrial Strategy (BEIS) CHP Quality Assurance (CHPQA) Programme.

The CHPQA Programme was introduced at the same time as CCL in 2001 and, like most government programmes, has developed tighter rules to ensure the programme works to its best abilities. The CHP Quality Assurance programme (CHPQA) is a government initiative that aims to provide a methodology for assessing all types and sizes of Combined Heat & Power (CHP) schemes throughout the UK.

Those operating CHP units could (and still can) obtain an exemption from CCL on the gas used by the CHP scheme by registering with the CHPQA programme. However, HMRC mandated the requirement that annual reconciliation should be carried out. This entails determining the CCL paid in the previous year and retrospectively applying an actual exemption based upon an issued CHPQA certificate.

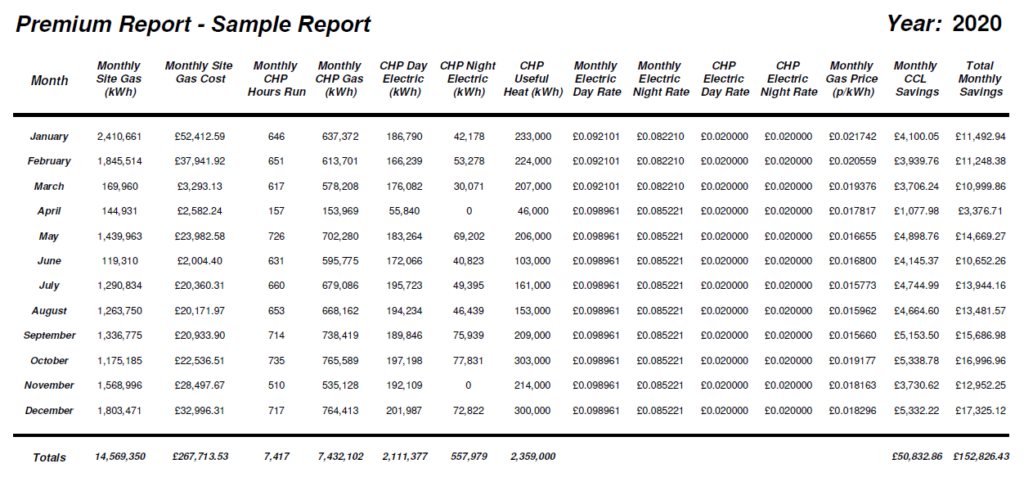

A good consultant will provide the operator of a CHP with a monthly and annual savings report. This will give the operator a detailed analysis of the performance of the CHP and the savings it is making the site.

For a more in depth look at CCL, you can read our whitepaper: Climate Change Levy (CCL) A multi-sector analysis of the cost difference of CCL rates 2018 – 2022

Beyond CCL and CHPs

The management of energy does not stop at onsite generation; with rising energy costs, energy efficiency must play a key role in a site’s overall strategy.

Energy costs will continue to rise and the need to reduce consumption through energy efficiency measures will help to minimise the impact of these rises.

2EA are an energy management consultancy which provides guidance on the legalities of energy legislation, as well as advice on Climate Change Levy Taxation, CHP & CHPQA Management, Energy Saving Opportunity Scheme (ESOS), Streamlined Energy & Carbon Reporting (SECR), Meter Verification, Medium Combustion Plant Directive (MCPD), Display Energy Certificates (DEC) and Building Energy Audits (BEA).

They have over 25 years’ experience and work with clients in various sectors, including supermarkets & retail, hotels, leisure centres, hospitals, schools, research centres and other private and public institutions.